What are payments on account?

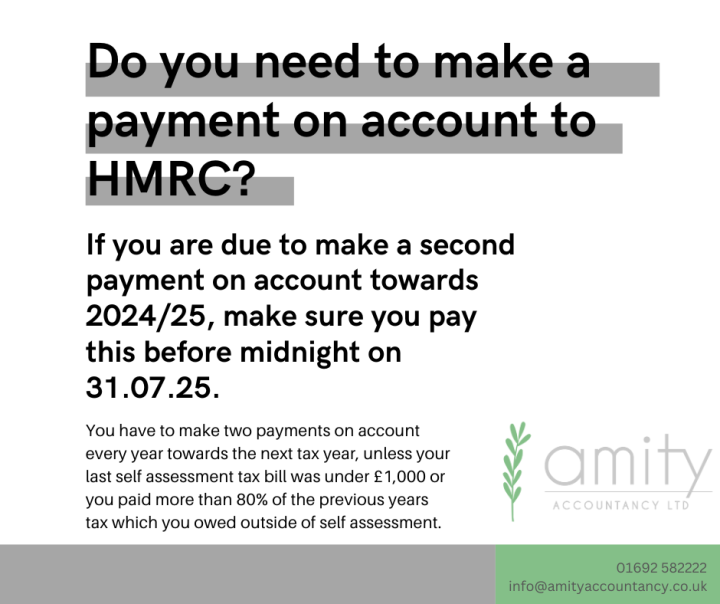

Payments on account aim to help individuals spread the cost of their self assessment tax liability, by making two payments each year; on 31st January and 31st July, towards the next tax year.

These payments are statutory if you owe £1,000 or more in tax for the last tax year and you paid under 80% of the previous years tax outside of self assessment.